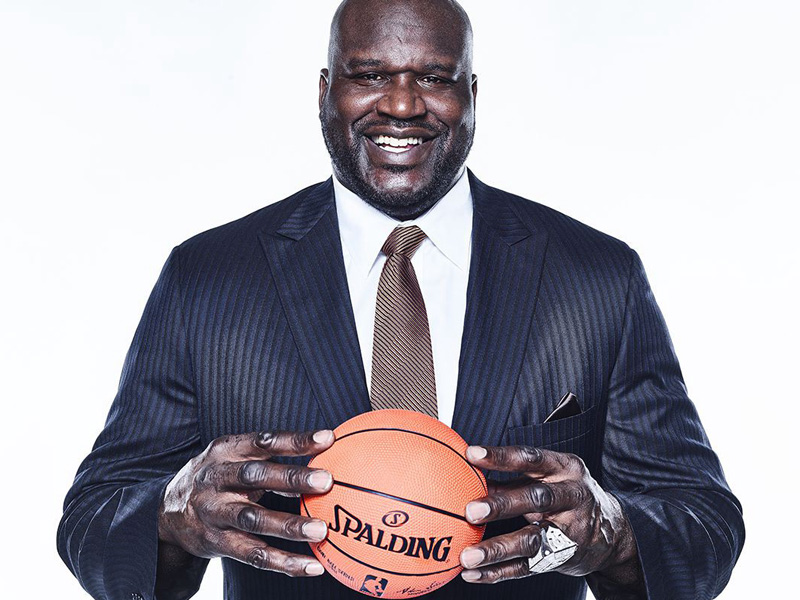

''I heard Jeff Bezos say one time that he makes his investments based on if it's going to change people's lives. And once I started doing that strategy, I think I probably quadrupled what I'm worth.''

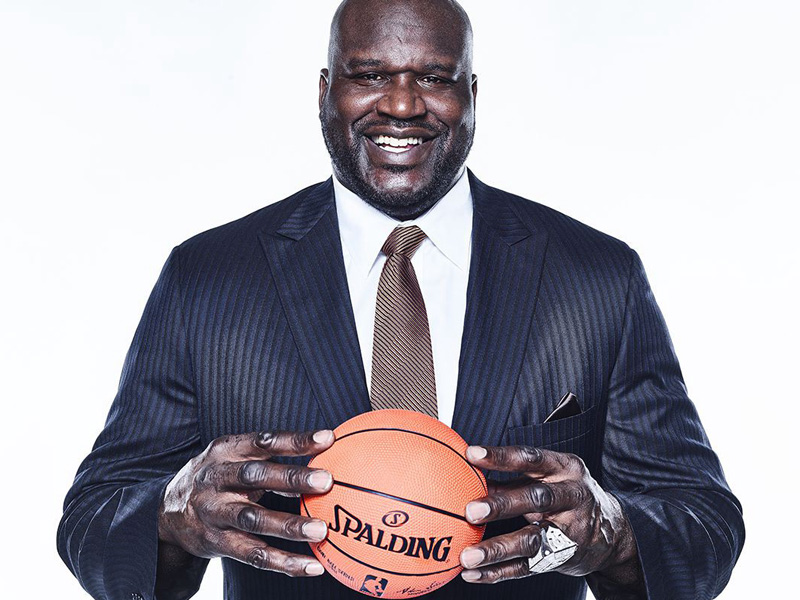

Since retiring from his 19-year basketball career in 2011, Shaquille O’Neal has seen just as much success off the court: He was an early investor in Google and has since accumulated an impressive portfolio, including investments in Apple, 24 Hour Fitness and nightclubs in Las Vegas. He also owns 17 Auntie Anne’s, a Krispy Kreme franchise and a Big Chicken restaurant in Las Vegas.

When it comes to investing, the former NBA star draws inspiration from Amazon’s founder and CEO: “I heard Jeff Bezos say one time [that] he makes his investments based on if it’s going to change people’s lives,” O’Neal told the Wall Street Journal in a recent interview. “Once I started doing that strategy, I think I probably quadrupled what I’m worth.”

It helps him decide what opportunities to jump on and which ones to pass up. “If something comes across my desk and I don’t believe in it, I don’t even look at it,” said O’Neal, even if it looks excellent on paper. In fact, he rarely focuses on the numbers: “Whenever I do business, it’s not about the money.”

As he told CNBC’s Bob Pisani last year, “I never say, ‘If I invest in this, five years down the line, we could sell it for this.’ Every time I’ve had that model, it’s always been a failure.”

He’s not the only successful investor who sticks with what he knows and trusts. “Make sure you’re investing in things that you believe in, as opposed to investing in things that other people believe in,” PayPal’s senior vice president of international markets, Rohan Mahadevan, tells CNBC Make It. He recommends testing a product or service before investing in it to better understand how the business operates.

O’Neal also prefers to work with companies he personally enjoys. Of all of his investments, Krispy Kreme is his favorite, he told the WSJ, “because I like donuts. ... Krispy Kreme is a fabulous donut. I was introduced to it in college and have been in love with it ever since.”

That said, you don’t necessarily want to invest in something just because you like it. You want to make sure you truly understand the company, too, says legendary investor Warren Buffett: “What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.

“The size of that circle is not very important; knowing its boundaries, however, is vital.”

Simply put, when it comes to investing, Buffett says to stick to what you know. “Defining what your game is — where you’re going to have an edge — is enormously important.”

Once you’ve done that, buy and hold, he adds: “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

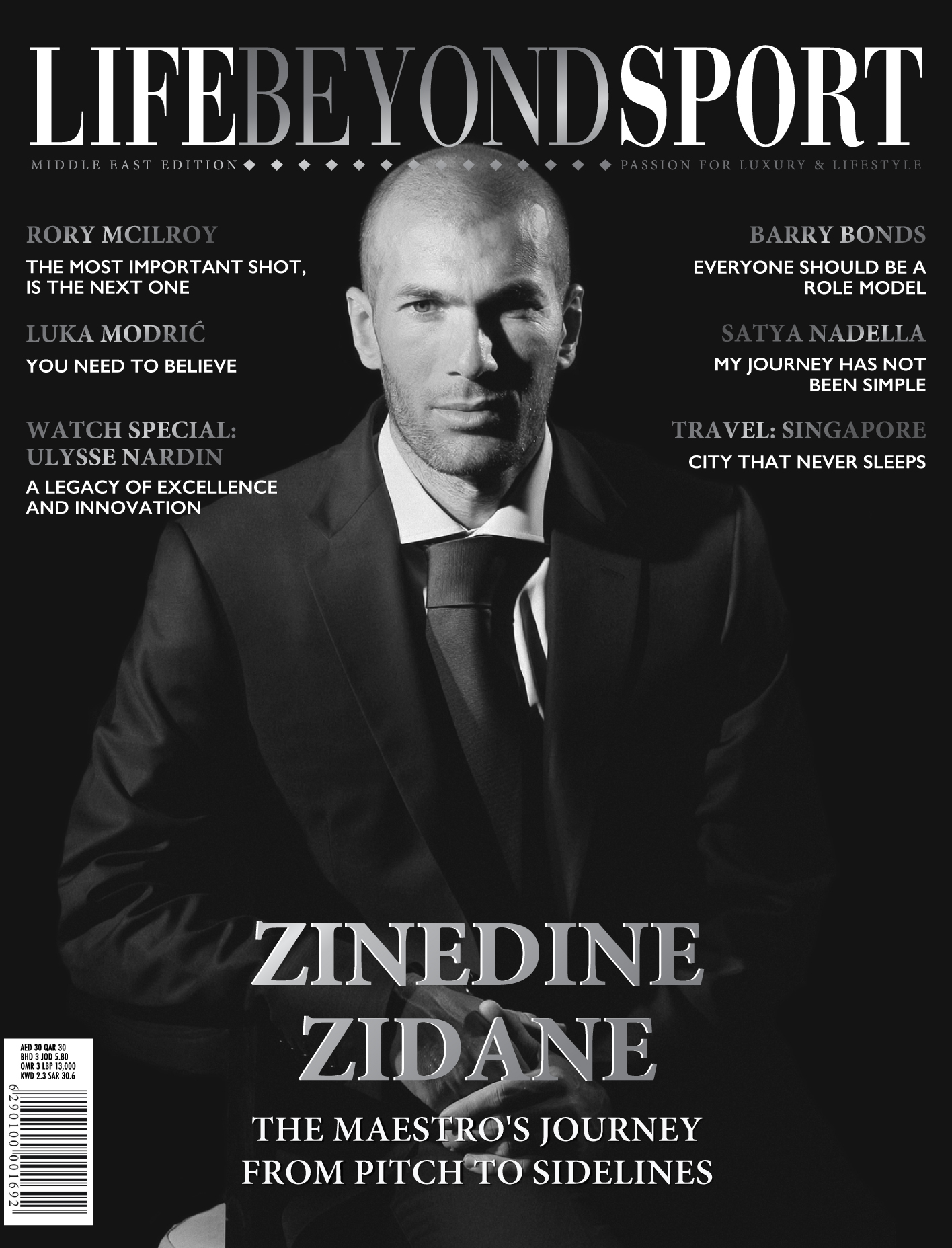

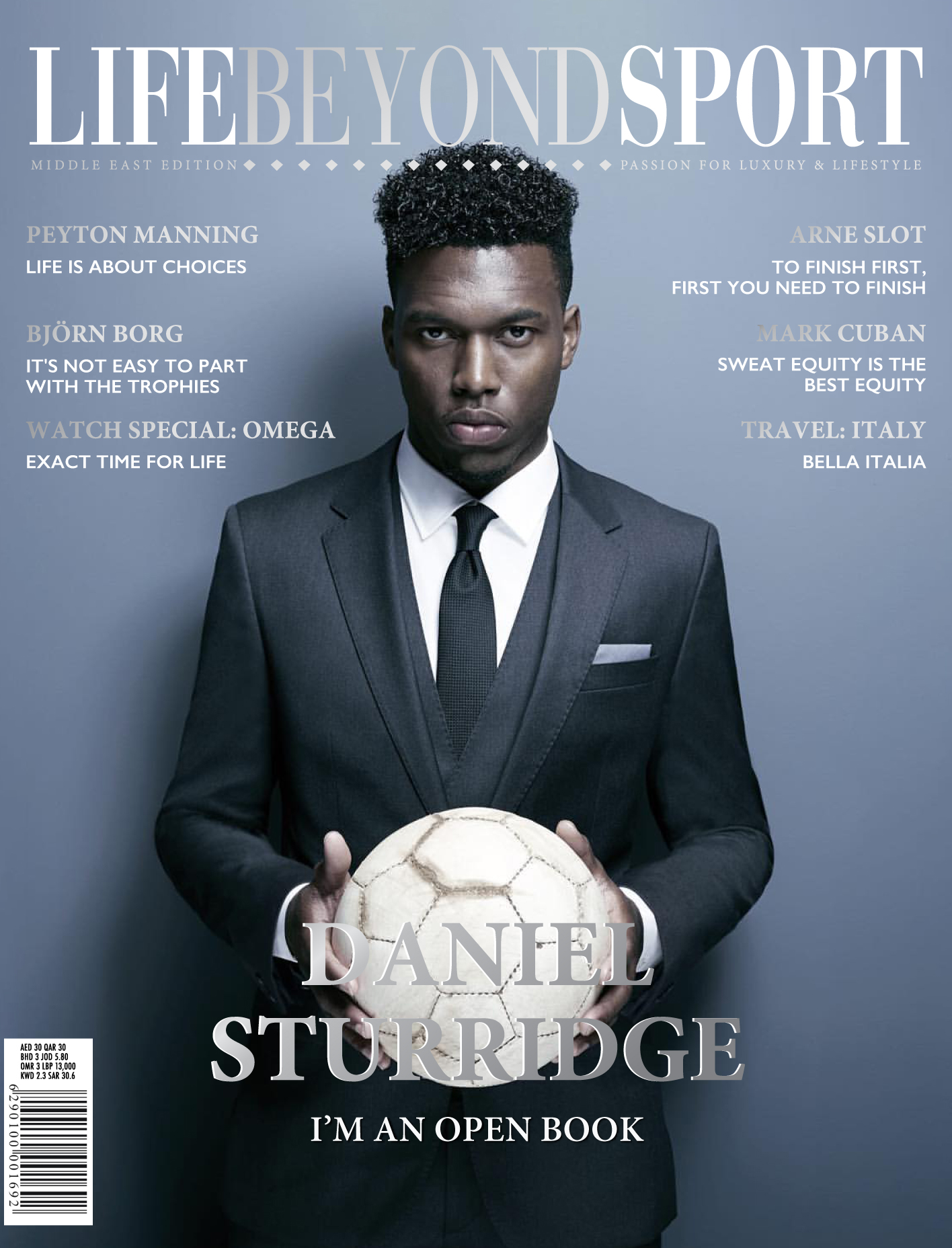

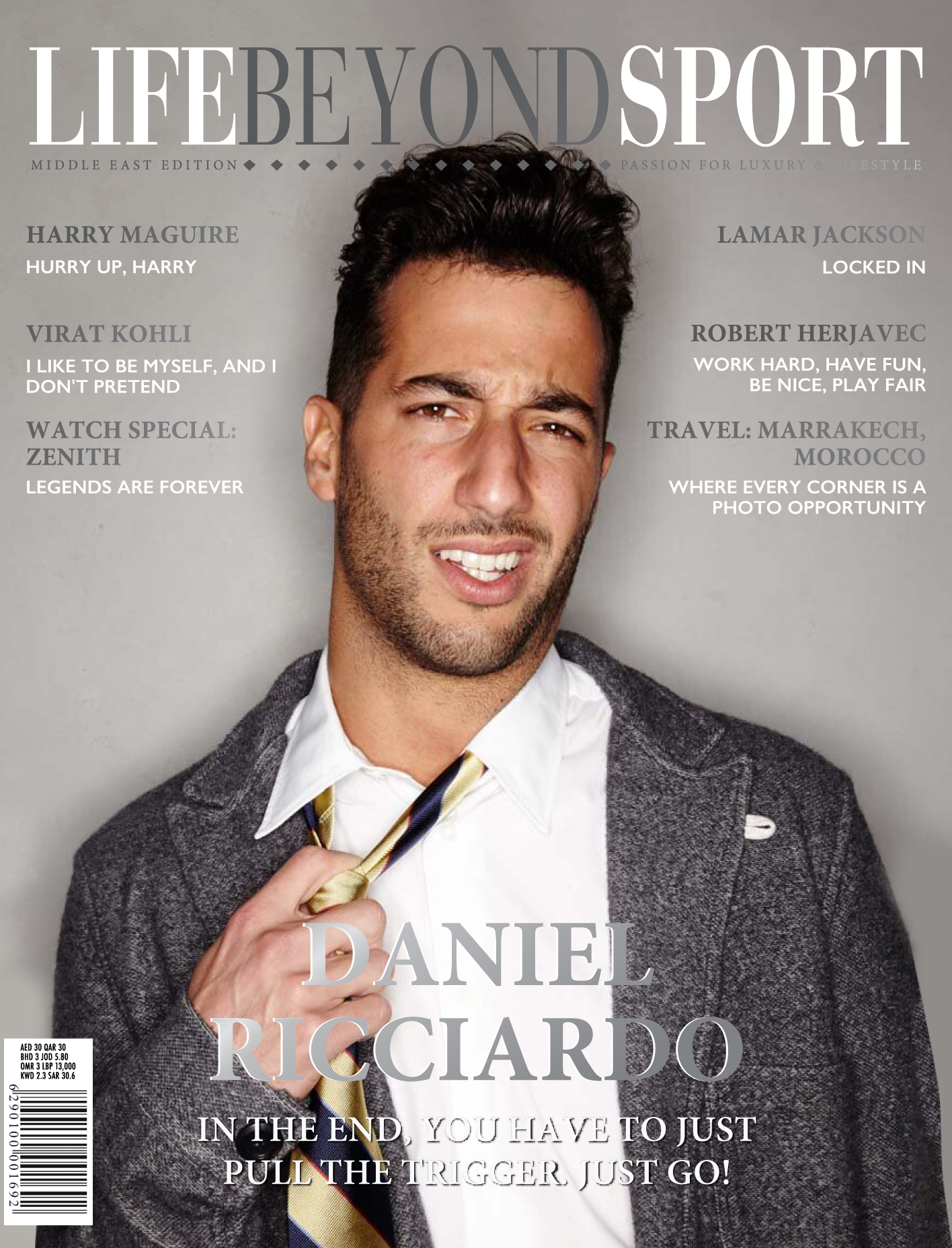

.jpg) Life Beyond Sport magazine is a pioneering publication that breaks through the traditional barriers of men’s lifestyle magazines by smoothly combining a man’s love of sport with his passion for the finer things in life. The magazine contains a range of features, interviews and photo-shoots that provide an exclusive insight into the sportsman’s lifestyle. Only in Life Beyond Sport will you find the biggest names from the worlds of Football, Tennis, Formula 1, Golf, Polo and more.

Life Beyond Sport magazine is a pioneering publication that breaks through the traditional barriers of men’s lifestyle magazines by smoothly combining a man’s love of sport with his passion for the finer things in life. The magazine contains a range of features, interviews and photo-shoots that provide an exclusive insight into the sportsman’s lifestyle. Only in Life Beyond Sport will you find the biggest names from the worlds of Football, Tennis, Formula 1, Golf, Polo and more.